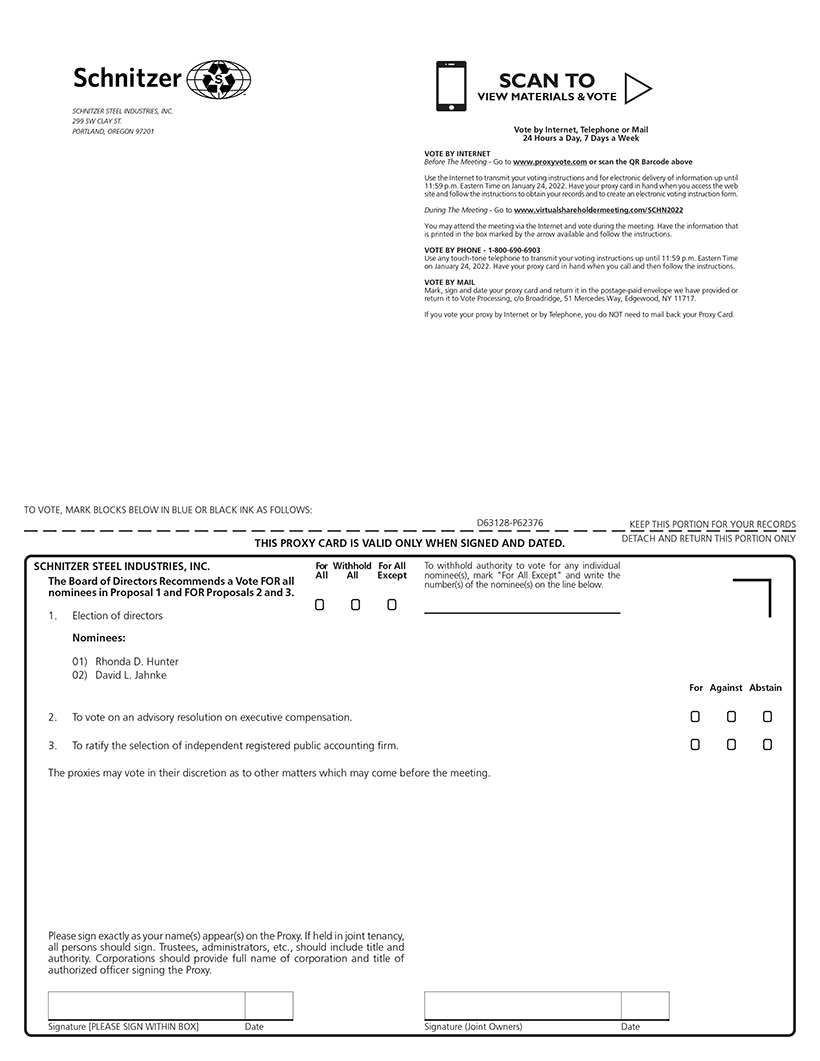

• | | By TelephoneBy Telephone: – If you have access to a touch-tone telephone, you may submit your proxy by dialing1-800-690-6903 and by following the recorded instructions. You will need the16-digit number included on your Notice or your proxy card in order to vote by telephone. By Mail: You may vote by mail by requesting a proxy card from us, indicating your vote by completing, signing, and dating the card where indicated and by mailing or otherwise returning the card in the envelope that will be provided to | | | | Notice of Annual Meeting of Shareholders and 2021 Proxy Statement | | | 18 |

| | |

| | Questions and Answers About These Proxy Materials and Voting |

• | | By Mail – You may vote by mail by requesting a proxy card from us, indicating your vote by completing, signing, and dating the card where indicated and by mailing or otherwise returning the card in the envelope that will be

|

| | provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney, or officer of a corporation), indicate your name and title or capacity.

|

| • | | Online During the Virtual Annual Meeting:In Person – You may cast your vote in person by attendingonline at the virtual Annual Meeting. We will give you a ballotMeeting during the window when you arrive.the polls are open. Even if you plan to attend the virtual meeting, we encourage you to vote by Internet, telephone, or mail in advance of the meeting so your vote will be counted if you later decide not to or cannot attend the virtual meeting. If you attend the Annual Meeting, you may then revoke your proxy and vote in person if you desire. |

We provide Internet proxy voting to allow you to vote your shareson-line, online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. While there is no specific charge or cost to you for voting by Internet, please be aware that you must bear any costs | | | | | 14 | | | Notice of Annual Meeting of Shareholders and 2018 Proxy Statement |

| | |

| | Questions and Answers About These Proxy Materials and Voting

|

associated with your Internet access, such as usage charges from Internet access providers and telephone companies. Internet voting online in advance of the meeting and telephone voting facilities will close at 11:59 p.m. (Eastern time) on January 28, 201924, 2022 for the voting of shares. What if I return a proxy card but do not make specific choices? If you are a shareholder of record and return a signed and dated proxy card without marking any voting selections, your shares will be voted “FOR”FOR the election of each of the nominees for director set forth in this proxy statement, “FOR” the advisory resolution on executive compensation, and “FOR”FOR the ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal 2019.2022. If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his or her best judgment. If you are a beneficial owner of shares held in street name and return signed and dated voting instructions without marking any voting selections, your shares may be voted at the discretion of your broker with respect to the ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal 20192022 (Proposal No. 3) but may not be voted with respect to the election of directors (Proposal No. 1), or the advisory vote related to executive compensation (Proposal No. 2). If any matter which is considered routine is properly presented at the meeting, your proxy (one of the individuals named on the proxy card) will vote your shares using his or her best judgment. Please return your voting instructions with your voting selections marked so that your vote can be counted. What constitutes a quorum? Holders of Class A common stock and Class B common stock will vote together as a single class on all matters voted on at the Annual Meeting, and each share is entitled to one vote. A majority of the total outstanding shares of Class A and Class B common stock must be present or represented by proxy to constitute a quorum at the Annual Meeting. Shares voted by proxy on any matter (including shares voted pursuant to a broker’s discretionary voting authority) are counted as present at the meeting for purposes of determining a quorum. How many votes are required to approve each proposal? The election of directors (Proposal No. 1) will be determined by a plurality of the votes cast by the shares entitled to vote in the election at the meeting, assuming a quorum is present. A plurality vote requirement means that the threetwo director nominees with the greatest number of votes cast, even if less than a majority, will be elected. There is no cumulative voting. The advisory vote on executive compensation (Proposal No. 2) will be approved if the votes cast favoring the proposal exceed the votes cast opposing the proposal. While the vote on executive compensation (Proposal No. 2) is advisory in nature andnon-binding, the Board and the Compensation Committee will review the voting results and intend to carefully consider the results when making future decisions regarding executive compensation. The ratification of the selection of the independent registered public accounting firm (Proposal No. 3) will be approved if the votes cast favoring the proposal exceed the votes cast opposing the proposal. | | | | Notice of Annual Meeting of Shareholders and 2021 Proxy Statement | | | 19 |

| | |

| | Questions and Answers About These Proxy Materials and Voting |

How are votes counted? With respect to the election of directors, you may vote “FOR” or “WITHHOLD” with respect to each nominee. Votes that are withheld will be excluded entirely from the vote with respect to the nominee from which they are withheld. Votes that are withheld will not have any effect on the outcome of the election of directors. You may vote “FOR”, “AGAINST”, or “ABSTAIN” with respect to the advisory vote on executive compensation (Proposal No. 2), and the vote on the ratification of the selection of the independent registered public accounting firm (Proposal No. 3). For Proposal Nos. 2 and 3, abstentions will not have any effect on the outcome of the vote. | | | | | | | Notice of Annual Meeting of Shareholders and 2018 Proxy Statement | | | | 15 | |

| | |

| | Questions and Answers About These Proxy Materials and Voting

|

What is a “brokernon-vote” and how does it affect voting on each item? A broker who holds shares for a beneficial owner has the discretion to vote on “routine” proposals when the broker has not received voting instructions from the beneficial owner. A “brokernon-vote” occurs when shares held by a broker are not voted with respect to a proposal because (1) the broker has not received voting instructions from the shareholder who beneficially owns the shares and (2) the broker lacks discretionary authority to vote the shares for that particular matter. Each of Proposal No. 1 (election of directors), and Proposal No. 2 (advisory vote on executive compensation) are considered to benon-routine matters, and brokers therefore lack discretionary authority to vote shares on such matters at this meeting. Brokernon-votes, like other shares that are not voted at the meeting, have no effect on the outcome of the vote on such matters. Can I change my vote after submitting my proxy? Yes. You can revoke your proxy at any time before the final vote at the meeting. You may revoke your proxy in any one of the following five ways: You may submit another properly completed proxy card with a later date that is received prior to the taking of the vote at the Annual Meeting. You may vote again on the Internet or by telephone before the closing of those voting facilities at 11:59 p.m. (Eastern time) on January 28, 201924, 2022 (only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted). You may provide a written notice that you are revoking your proxy to the Company’s Corporate Secretary at Schnitzer Steel Industries, Inc., 299 SW Clay Street, Suite 350, Portland, Oregon 97201, Attention: Corporate Secretary. | | Steel Industries, Inc., 299 SW Clay Street, Suite 350, Portland, Oregon 97201, Attention: Corporate Secretary, or hand-deliver it to the Corporate Secretary at or before the taking of the vote at the Annual Meeting.

|

You may attendvote online during the virtual Annual Meeting revokeby entering the 16-digit control number found on your proxy and vote in person.card, voting instruction form, or Notice, as applicable. Simply attending the virtual Annual Meeting will not, by itself, revoke your proxy. Remember that if you are a beneficial owner of Company shares holding shares in a street name, you may submit new voting instructions by contacting your bank, broker, or other nominee. You may also change your vote or revoke your proxy in person atonline during the virtual Annual Meeting ifafter you obtain a validlog-in by entering the 16-digit control number found on your Notice, voter instruction form, or proxy from the organization that is the record owner of your shares (such as your broker)card at www.virtualshareholdermeeting.com/SCHN2022. | | | | | 16 | | | Notice of Annual Meeting of Shareholders and 20182021 Proxy Statement | | | 20 |

Virtual Meeting Information Due to public health concerns relating to COVID-19 and to support the health and safety of our shareholders and employees, the Annual Meeting will be a virtual meeting, conducted exclusively via live audio webcast at www.virtualshareholdermeeting.com/SCHN2022. There will not be a physical location for the Annual Meeting, and you will not be able to attend the meeting in person. To participate in the virtual meeting, please visit www.virtualshareholdermeeting.com/SCHN2022 and enter the 16-digit control number included in your Notice, on your proxy card, or on the voting instruction form that accompanied your proxy materials. You may begin to log into the meeting platform beginning at 7:45 a.m. Pacific Time on Tuesday, January 25, 2022. The meeting audio webcast will begin promptly at 8:00 a.m. Pacific Time on Tuesday, January 25, 2022. The virtual meeting platform is fully supported across browsers and devices running the most updated version of applicable software and plug-ins. Please ensure that you have a strong Wi-Fi connection wherever you intend to participate in the meeting. Please also give yourself sufficient time to log-in and ensure you can hear the streaming audio before the meeting starts. Shareholders will be able to submit questions live during the virtual meeting by typing the question into the “Ask a Question” field, and clicking submit. We will answer questions that comply with the meeting rules of conduct during the Annual Meeting, subject to time constraints. If we receive substantially similar questions, we will group such questions together. Questions relevant to meeting matters that we do not have time to answer during the meeting will be posted to our website following the meeting. Questions regarding personal matters or matters not relevant to meeting matters will not be answered. Our rules of conduct will be posted at www.virtualshareholdermeeting.com/SCHN2022 at the outset of the Annual Meeting. If you encounter any technical difficulties with the virtual meeting website on the meeting day, please call the technical support number that will be posted on the virtual meeting log-in page. Technical support will be available starting at 7:45 a.m. Pacific Time and until the meeting has finished. At this time, we do not intend for this to be a permanent shift from in-person meetings. | | | | Notice of Annual Meeting of Shareholders and 2021 Proxy Statement | | | 21 |

Voting Securities and Principal Shareholders The record date for determining shareholders entitled to receive notice of and to vote at the Annual Meeting was December 3, 2018.November 29, 2021. At the close of business on December 3, 2018,November 29, 2021, a total of 27,026,15227,823,708 shares of our common stock, par value $1.00 per share, were outstanding and entitled to vote at the Annual Meeting. The outstanding common stock consisted of 26,826,15227,623,708 shares of Class A common stock (Class A) and 200,000 shares of Class B common stock (Class B). Each share of common stock (whether Class A or Class B) is entitled to one vote with respect to each matter to be voted on at the Annual Meeting. The following table sets forth certain information regarding the beneficial ownership of our common stock as of November 30, 201829, 2021 (unless otherwise noted in the footnotes to the table) by (i) persons known to us to be the beneficial owner of more than 5% of our common stock, (ii) each of our current directors, (iii) each nominee for director, (iv) each of our executive officersthe individuals listed in the Summary Compensation Table (each, a “named executive officer” and, collectively, the “named executive officers”), and (v) all of our current directors and executive officers as a group. Unless otherwise noted in the footnotes to the table, the persons named in the table have sole voting and investment power with respect to all outstanding shares of common stock shown as beneficially owned by them. Except as noted below, the address of each shareholder in the table is c/o Schnitzer Steel Industries, Inc., 299 SW Clay Street, Suite 350, Portland, Oregon 97201. Each Class B share is convertible into one Class A share, and there are no meaningful distinctions between the rights of holders of Class A shares and Class B shares. Accordingly, the following table reports beneficial ownership of common stock in the aggregate and does not distinguish between Class A shares and Class B shares. | | | | | | | | | Common Stock Beneficially Owned | | | | | Common Stock

Beneficially Owned | | | | Name of Beneficial Owner or Number of Persons in Group | | Number | | | Percent | | | Number | | Percent | | BlackRock Institutional Trust Company, N.A. | | | | 3,053,268 | (1) | | | 11.0 | % | The Vanguard Group, Inc. | | | 2,749,343 | (1) | | | 10.2 | % | | | 2,235,629 | (2) | | | 8.0 | % | BlackRock Institutional Trust Company, N.A. | | | 2,736,803 | (2) | | | 10.1 | % | | Dimensional Fund Advisors, L.P. | | | 2,265,024 | (3) | | | 8.4 | % | | | 2,214,749 | (3) | | | 8.0 | % | John D. Carter | | | 116,390 | | | | * | | | State Street Corp. | | | | 1,440,925 | (4) | | | 5.2 | % | Ameriprise Financial Inc. | | | | 1,407,905 | (5) | | | 5.1 | % | Wayland R. Hicks | | | 75,744 | (4) | | | * | | | | 106,874 | (6) | | | * | | Rhonda D. Hunter | | | 1,086 | (5) | | | * | | | | 21,540 | (7) | | | * | | David L. Jahnke | | | 33,393 | (6) | | | * | | | | 56,908 | (8) | | | * | | Judith A. Johansen | | | 52,933 | (7) | | | * | | | | 78,299 | (9) | | | * | | William D. Larsson | | | 53,933 | (8) | | | * | | | | 79,299 | (10) | | | * | | Glenda J. Minor | | | | 5,184 | (11) | | | * | | Michael W. Sutherlin | | | 21,159 | (9) | | | * | | | | 43,515 | (12) | | | * | | Tamara L. Lundgren | | | 516,867 | | | | 1.9 | % | | | 849,792 | | | | 3.1 | % | Richard D. Peach | | | 85,920 | | | | * | | | | 148,605 | | | | * | | Jeffrey Dyck | | | 61,034 | | | | * | | | Michael R. Henderson | | | | 87,613 | | | | * | | Steven G. Heiskell | | | 34,333 | | | | * | | | | 78,244 | | | | * | | Michael R. Henderson | | | 42,977 | | | | * | | | | | | | | | Peter B. Saba | | | | 37,066 | | | | * | | All current directors and executive officers as a group (14 persons) | | | 1,117,288 | | | | 4.1 | % | | | 1,734,805 | | | | 6.2 | % |

| (1) | Beneficial ownership as of MayDecember 31, 20182020 as reported by BlackRock Inc., 55 East 52nd Street, New York, NY 10055 in a Form 13G/A filed by the shareholder. |

| (2) | Beneficial ownership as of December 31, 2020 as reported by Vanguard Group, Inc., 100 Vanguard Blvd., Malvern, PA 19355 in a Form 13G/A filed by the shareholder. |

(2) | Beneficial ownership as of December 31, 2017 as reported by BlackRock Inc., 55 East 52nd Street, New York, NY 10055 in a Form 13G/A filed by the shareholder.

|

| (3) | Beneficial ownership as of December 31, 20172020 as reported by Dimensional Fund Advisors LP, 6300 Bee Cave Road, Building One, Austin, TX 78746 in a Form 13G/A filed by the shareholder. |

| (4) | Beneficial ownership as of December 31, 2020 as reported by State Street Corp., One Lincoln Street, Boston, MA 02111 in a Form 13G filed by the shareholder. |

| (5) | Beneficial ownership as of December 31, 2020 as reported by Ameriprise Financial Inc., 145 Ameriprise Financial Center, Minneapolis, MN 55474 in a Form 13G filed by the shareholder. |

| (6) | Includes 68,64495,768 shares covered by vested deferred stock units (“DSUs”) or credited to an accountand 4,006 shares covered by unvested DSUs that will vest on January 24, 2022 under the Deferred Compensation Plan forNon-Employee Directors (the “Director DCP”). See footnote 2 to the Directors Compensation Table on page 2937 for additional information. |

(5)(7) | Includes 1,08617,534 shares covered by vested deferred stock units (“DSUs”) and 4,006 shares covered by unvested DSUs that are issuable to such director pursuant to vested DSUswill vest on January 24, 2022 under the Director DCP.Deferred Compensation Plan for Non-Employee Directors (the “Director DCP”). |

(6)(8) | Includes 33,39352,902 shares covered by vested deferred stock units (“DSUs”) and 4,006 shares covered by unvested DSUs that are issuable to such director pursuant to vested DSUswill vest on January 24, 2022 under the Director DCP.Deferred Compensation Plan for Non-Employee Directors (the “Director DCP”). |

| | | | | | | Notice of Annual Meeting of Shareholders and 20182021 Proxy Statement | | | | 17 | 22 |

| | |

| | Voting Securities and Principal Shareholders |

(7) | Includes 52,933 shares that are issuable to such director pursuant to vested DSUs under the Director DCP.

|

(8) | Includes 52,933 shares that are issuable to such director pursuant to vested DSUs under the Director DCP.

|

| (9) | Includes 21,15974,293 shares covered by vested deferred stock units (“DSUs”) and 4,006 shares covered by unvested DSUs that are issuable to such director pursuant to vested DSUswill vest on January 24, 2022 under the Director DCP.Deferred Compensation Plan for Non-Employee Directors (the “Director DCP”). |

Section 16(a) Beneficial Ownership Reporting Compliance

| (10) | Includes 74,293 shares covered by vested deferred stock units (“DSUs”) and 4,006 shares covered by unvested DSUs that will vest on January 24, 2022 under the Deferred Compensation Plan for Non-Employee Directors (the “Director DCP”). |

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers, and persons who beneficially own more than 10% of our outstanding common stock to file with the SEC reports of beneficial ownership and changes in beneficial ownership of our common stock held by such persons. Executive officers, directors, and greater than 10%

shareholders are also required to furnish us copies of all forms they file under this regulation. To our knowledge, based solely on a review of the copies of such reports furnished to us and representations that no other reports were required during fiscal 2018, we believe that all required Section 16(a) reports were timely filed for such fiscal year.

| (11) | Includes 1,178 shares covered by vested deferred stock units (“DSUs”) and 4,006 shares covered by unvested DSUs that will vest on January 24, 2022 under the Deferred Compensation Plan for Non-Employee Directors (the “Director DCP”). |

Certain Transactions

The Audit Committee charter requires the Audit Committee to review any reportable transaction or proposed transaction with a related person, or in which a related person has a direct or indirect interest, and determine whether to ratify or approve the transaction, with ratification or approval to occur only if the Audit Committee determines that the transaction is fair to the Company or that approval or ratification of the transaction is in the interest of the Company.

One of our executive officers, Michael Henderson, has an immediate family member, Brian Henderson, who is employed by a subsidiary of the Company. The compensation

of Brian Henderson was established by the Company in accordance with its employment and compensation practices applicable to employees with equivalent qualifications and responsibilities and holding similar positions. Michael Henderson does not have a material interest in the employment relationship nor does he share a household with the employee. Brian Henderson received fiscal 2018 compensation of $173,800. There were no other reportable related person transactions during fiscal 2018.

| (12) | Includes 39,509 shares covered by vested deferred stock units (“DSUs”) and 4,006 shares covered by unvested DSUs that will vest on January 24, 2022 under the Deferred Compensation Plan for Non-Employee Directors (the “Director DCP”). |

| | | | | 18 | | | Notice of Annual Meeting of Shareholders and 20182021 Proxy Statement | | | 23 |

Proposal No. 1 – Election of Directors We are asking shareholders to elect the threetwo individuals nominated by the Board, each of whom is a current director. The Board currently consists of eight members divided into three classes pursuant to our 2006 Restated Articles of Incorporation and Restated Bylaws. One class of directors is elected each year for a three-year term. The term of Class I directors expires at the 2019 annual meeting;2022 Annual Meeting; the term of Class II directors expires at the 20202023 annual meeting; and the term of Class III directors expires at the 20212024 annual meeting. Generally, the terms of directors continue until their respective successors are duly elected and qualified. Action will be taken at the 20192022 Annual Meeting to elect threetwo Class I directors to serve until the 20222025 annual meeting of shareholders. Following consideration of William D. Larsson’s indication of interest in retiring from the Board at the end of his term in accordance with the Company’s term limit policy, Mr. Larsson, a current Class I director, has not been re-nominated for election as a director, and his term as a director will end at the 2022 Annual Meeting. The Board of Directors has approved a decrease in the number of directors from eight to seven effective immediately prior to the 2022 Annual Meeting. The nominees for election at the 20192022 Annual Meeting are Rhonda D. Hunter and David L. Jahnke and William D. Larsson as Class I directors. The Board has determined that Ms. Hunter and Messrs.Mr. Jahnke and Larsson qualify as independent directors under our Corporate Governance Guidelines, SEC rules, and NASDAQ requirements. If any nominee is unable to stand for election, the persons named in the proxy will vote the proxy for a substitute nominee in accordance with the recommendation of the Board. We are not aware of any nominee who is or will be unable to stand for election. Class I Director Nominees | | | | | | | | | | | | | |

| | Rhonda D. Hunter Age: 5659 Director Since: 2017 | | Company Board Committees: • Audit; NominatingCompensation Other Public Company Directorships: • Interfor Corporation, Member of the Management Resources & Compensation Committee and Chair of the Corporate Governance, Responsibility & Nominating Committee Qualifications and Skills to Serve as a Director: | | | | | | | | • Experience as a senior executive at a commodities-based public company • Expertise in inventory and planning, environmental and work systems, finance and accounting, international business, strategic planning, growth management, operational integration, and operations | | | | | | | | | | • Public company board and committee experience |

Ms. Hunterwas Senior Vice President, Timberlands, of Weyerhaeuser Company, a North American timberland company, from 2014 until her retirement in January 2018.2019. Ms. Hunter was Vice President, Southern Timberlands, of Weyerhaeuser from 2010 to 2014. Ms. Hunter previously held a number of financial and operational leadership positions within Weyerhaeuser with increasing P&L responsibility. Ms. Hunter joined Weyerhaeuser in 1987 as an accountant. Ms. Hunter holds a Bachelor of Science in Accounting from Henderson State University and has completed executive education at Harvard Business School and Duke University. | | | | Notice of Annual Meeting of Shareholders and 2021 Proxy Statement | | | 24 |

| | |

| | Proposal No. 1 – Election of Directors |

| | | | | | | | | |

| | | |  | | David L. Jahnke Age:6568 Director Since:2013 | | Company Board Committees: • Audit, Chair; Compensation Other Public Company Directorships: • First Interstate BancSystem, Inc., Chair of Board; Chair of the Executive Committee and Member of the Governance & Nominating Committee Qualifications and Skills to Serve as a Director: | | Other Public Company

Directorships:

• First Interstate BancSystem, Inc. Member of Executive Committee, Risk Committee and Chair of Audit Committee

| | | | | | • Public accounting, financial reporting, and internal controls experience • Experience in complex financial transactions, international business and executive compensation • Public company board and committee leadership experience | | | | | | | | | | |

Mr. Jahnkeheld various positions at KPMG, the international accounting firm, from 1975 until 2010. From 2005 to 2010, he was the Global Lead Partner for a major KPMG client and was located in KPMG’s Zurich, Switzerland office. Prior to that time, he held positions of increasing responsibility at KPMG, including Office Managing Partner and Audit Partner in Charge of the Minneapolis office from 1999 to 2004. He is a director of Swiss Re America Holding Corporation where he serves as Chair of its Audit Committee and is a member of its Executive Committee. Mr. Jahnke holds a B.S. in Accounting from the University of Minnesota-Twin Cities. | | | | | | | Notice of Annual Meeting of Shareholders and 2018 Proxy Statement | | | | 19 | |

| | |

| | Proposal No. 1 – Election of Directors

|

| | | | | | | | | | | | | |  | | William D. Larsson

Age:73

Director Since:2006

| | Company Board Committees:

• Nominating and Corporate Governance, Chair; Audit

Qualifications and Skills to Serve as a Director:

| | Other Public Company

Directorships:

• Clearwater Paper Corporation, Vice-Chair of Board and Chair of Audit Committee

| | | | | | • Former public company Chief Financial Officer

• Experience in general manufacturing, international business, mergers and acquisitions, executive compensation, strategic analysis, and growth management and organizational integration

• Public company board and committee leadership experience

| | | | | | | | | | |

Mr. Larsson was Senior Vice President and Chief Financial Officer from 2000 until 2009, of Precision Castparts Corp., a leading manufacturer of complex metal components and products principally for the aerospace and power generation

industries. He earned a B.S. in Economics and a B.S. in Mathematics from the University of Oregon and an MBA from California State University at Long Beach.

Vote Required to Elect Directors Holders of Class A Common Stock and Class B Common Stock will vote together as a single class on this matter, and each share is entitled to one vote for each director nominee. Directors are elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. Proxies received from shareholders of record, unless directed otherwise, will be voted FOR the election of each of the nominees. Abstentions and brokernon-votes will have no effect on the results of the vote. The Board of Directors recommends that shareholders vote“FOR” the election

of each of the nominees named above.

| | | | | 20 | | | Notice of Annual Meeting of Shareholders and 2018 Proxy Statement |

| | |

each of the nominees named above.

| | Proposal No. 1 – Election of Directors

|

Continuing Directors

Class II Directors | | | | | | | | | |

| | | |  | | Wayland R. Hicks Age:76 78 Director Since:2009 | | Company Board Committees: • Lead Director; Compensation; Nominating and& Corporate Governance Qualifications and Skills to

Serve as a Director:

| | Other Public Company Directorships: • United Rentals, Inc. (1998-2009) | | | | | | Qualifications and Skills to Serve as a Director: • Former Chief Executive Officer of public companies • Expertise in operations, general manufacturing, international business, mergers and acquisitions, logistics, executive compensation, and strategic planning and analysis | | | | | | | | | | • Public company board and committee experience |

Mr. Hicksserved as Director and Vice Chairman of United Rentals, Inc., a construction equipment rental company, from 1998 until March 2009. At United Rentals, Inc., he also served as Chief Executive Officer from December 2003 until June 2007 and Chief Operating Officer from 1997 until December 2003. Mr. Hicks served as Chief Executive Officer and President of Indigo N.V., a manufacturer of commercial and industrial printers, from 1996 to 1997, and as Vice Chairman and Chief Executive Officer of Nextel Communications Corp. from 1994 to 1995. From 1967 to 1994, he held various executive positions with Xerox Corporation. Mr. Hicks also served as a Director of Perdue Farms Inc. from 1991 to 2014. Mr. Hicks holds a B.A. degree in Economics from Indiana University. | | | | Notice of Annual Meeting of Shareholders and 2021 Proxy Statement | | | 25 |

| | |

| | Proposal No. 1 – Election of Directors |

| | | | | | | | | |

| | | |  | | Judith A. Johansen Age:6063 Director Since:2006 | | Company Board Committees: • Compensation, Chair; Nominating & Corporate Governance Nominating

Other Public Company Directorships: • IDACORP and Idaho Power Company, Member of Compensation and Corporate Governance & Nominating Committees Qualifications and Skills to Serve as a Director: | | Other Public Company

Directorships:

• IDACORP and Idaho Power

Company, Member of Compensation and Corporate Governance & Nominating Committees

| | | | | | • Former Chief Executive Officer of a public reporting company • Expertise in operations, general manufacturing, international business, mergers and acquisitions, logistics, executive compensation, and strategic planning and analysis • Public company board and committee experience | | | | | | | | | | |

Ms. Johansenserved as President of Marylhurst University in Lake Oswego, Oregon, a position she held from July 2008 to September 1, 2013. From December 2001 through March 2006, Ms. Johansen was President and Chief Executive Officer of PacifiCorp, an electric utility, and was their Executive Vice President of Regulation and External Affairs from December 2000 to December 2001. She was Administrator and Chief Executive Officer of the Bonneville Power Administrator, a regional Federal power marketing agency, from 1998 to 2000. Ms. Johansen earned her B.A. in Political Science from Colorado State University and her J.D. from Northwestern School of Law at Lewis & Clark College. | | | | | | | Notice of Annual Meeting of Shareholders and 2018 Proxy Statement | | | | 21 | |

| | |

| | Proposal No. 1 – Election of Directors

|

| | | | | | | | | | | | | |  | | Tamara L. Lundgren Age:6164 Director Since:2008 | | Company Board Committees: • None (Ms. Lundgren is the Company’s CEO)Board Chairman Other Public Company Directorships: • Ryder System, Inc., Member of Audit and Corporate Governance & Nominating Committees Qualifications and Skills to Serve as a Director: | | Other Public Company

Directorships:

• Ryder System, Inc.,

Member of Audit and Corporate Governance & Nominating Committees

| | | | | | | • Chief Executive Officer of Schnitzer Steel Industries, Inc. • Expertise in commodities, strategic planning and analysis, finance, operations, change management, international business, government and community relations, mergers and acquisitions, and investment banking • Public company board and committee experience | | | | | | | | | | | |

Ms. Lundgrenhas served as President, Chief Executive Officer and a Director of the Company since December 2008.2008 and as Chairman of the Board since March 2020. Ms. Lundgren joined the Company in September 2005 as Vice President and Chief Strategy Officer, and held positions of increasing responsibility including President of Shared Services and Executive Vice President and Chief Operating Officer. Prior to joining the Company, Ms. Lundgren was a managing director in investment banking at JPMorgan Chase, which she joined in 2001. From 1996 until 2001, Ms. Lundgren was a managing director of Deutsche Bank AG in New York and London. Prior to joining Deutsche Bank, Ms. Lundgren was a partner at the law firm of Hogan Lovells (formerly Hogan & Hartson, LLP) in Washington, D.C. Ms. Lundgren also currently serves as a DirectorDeputy Chair of the Board of Directors of the Federal Reserve Bank of San Francisco. She earned her B.A. from Wellesley College and her J.D. from the Northwestern University School of Law. Class III Directors

| | | | | | | | | | | | | |  | | John D. Carter

Age:72

Director Since:2005

| | Company Board Committees:

• Board Chairman

Qualifications and Skills to

Serve as a Director:

| | Other Public Company

Directorships:

•Northwest Natural Gas Company, Member of Governance and Finance Committee and Chair of Audit Committee

•FLIR Systems, Inc., Chair of Corporate Governance Committee

| | | | | | • Former Chief Executive Officer of Schnitzer Steel Industries, Inc.

• Extensive international business experience

• Expertise in strategic planning and analysis, mergers and acquisitions, operations, environmental affairs, and government relations

• Public company board and committee leadership experience

| | | | | | | | | | |

Mr. Carter has been Chairman of the Board since December 2008 and was President and Chief Executive Officer of the Company from May 2005 to December 2008. From 2002 to May 2005, Mr. Carter was engaged in a consulting practice focused primarily on strategic planning in transportation and energy for national and international businesses, while also owning other small business ventures. From 1982 to 2002, Mr. Carter served in a variety of senior management

capacities at Bechtel Group, Inc., an engineering and construction company, including as Executive Vice President and Director, as well as President of Bechtel Enterprises, Inc., a wholly-owned subsidiary, and other operating groups. He retired from Bechtel at the end of 2002. Prior to his Bechtel tenure, Mr. Carter was a partner in a San Francisco law firm. He is a graduate of Stanford University and Harvard Law School.

| | | | | 22 | | | Notice of Annual Meeting of Shareholders and 20182021 Proxy Statement | | | 26 |

| | |

| | Proposal No. 1 – Election of Directors |

Class III Directors | | | | | | | | | | | | | |  | | Michael W. Sutherlin

Age:72

Director Since:2015

| | Glenda J. Minor Age: 65 Director Since: 2020 | | Company Board Committees: • Audit; Nominating and Corporate Governance Other Public Company Directorships: Compensation;• Curtiss-Wright Corporation, Member of the Audit Committee and the Committee on Directors and Governance

• Albermarle Corporation, Member of the Audit & Finance and Nominating & Governance Committees Qualifications and Skills to Serve as a Director: • Former Chief Financial Officer of a leading steel manufacturer • In-depth understanding of the preparation and analysis of financial statements, experience in financial reporting and internal controls • Experience in capital market transactions, investor relations, mergers and acquisitions, and international business • Public company board and committee experience |

Ms. Minor has served as Chief Executive Officer and Principal of Silket Advisory Services, a privately owned consulting firm, since 2016. Silket Advisory Services advises companies on financial, strategic, and operational initiatives. From 2010 until 2015, Ms. Minor was Senior Vice President and Chief Financial Officer of EVRAZ North America Limited, a leading steel manufacturer. Prior to this, Ms. Minor held both domestic and international executive finance roles at increasing levels of managerial responsibility at Visteon Corporation and DaimlerChrysler, as well as financial management roles at General Motors Corporation and General Dynamics Corporation. Ms. Minor holds a Bachelor’s degree in Accounting from Southern University in Baton Rouge, Louisiana and an MBA in International Business from Michigan State University. | | | | |

| | Michael W. Sutherlin Age: 75 Director Since: 2015 | | Company Board Committees: • Compensation; Nominating and Corporate Governance Other Public Company Directorships: • Peabody Energy Corporation, Member of the Compensation Committee and Chair of the Nominating CommitteeAudit Committees | | | | | | Qualifications and Skills to Serve as a Director: • Experience as public company Chief Executive Officer and public company Board Chairman • Manufacturing and mining sector experience • Core operations, executive leadership, international business, and executive compensation experience | | | | | | | | | | • Public company board and committee experience |

Mr. Sutherlinserved as President and Chief Executive Officer and Director of Joy Global, Inc., a manufacturer and servicer of mining equipment for the extraction of coal and other minerals and ores, from 2006 until 2013. He was Executive Vice President, President and Chief Operating Officer of Joy Mining Machinery from 2003 to 2006. Prior to that time, Mr. Sutherlin held positions of increasing responsibility for Varco International, Inc., including President and Chief Operating Officer and Division President. Mr. Sutherlin holds a Bachelor of Business Administration from the Texas Tech University and an MBA from the University of Texas at Austin. | | | | Notice of Annual Meeting of Shareholders and 2021 Proxy Statement | | | 27 |

| | |

| | Proposal No. 1 – Election of Directors |

Corporate Governance The Company is committed to strong corporate governance. The Company is governed by a Board of Directors and Committees of the Board that meet throughout the year. Directors discharge their responsibilities at Board and Committee meetings and also through other communications with management. Our Board of Directors has an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee (the “N&CG Committee”), each of which has a written charter adopted by the Board of Directors, copies of which are posted on our website at www.schnitzersteel.com.www.schnitzersteel.com. The Board of Directors has also adopted Corporate Governance Guidelines which are posted on our website. Under our Corporate Governance Guidelines, committee members are appointed annually and the chairs of, and director membership on, committees are periodically rotated based on the skills, desires, and experiences of the members of the Board. Director Independence The Board of Directors has determined that Wayland R. Hicks, Rhonda D. Hunter, David L. Jahnke, Judith A. Johansen, William D. Larsson, Glenda J. Minor, and Michael W. Sutherlin are “independent directors” as defined by our Corporate Governance Guidelines, SEC rules, and NASDAQ listing requirements. Accordingly, a majority of the directors have been determined to be independent directors. The independent directors regularly meet in executive sessions at which only independent directors are present. The independent directors serve on the following committees: | | | | | | | | | | | | | | Board Committees | Director

| | Audit

| | Compensation

| | Nominating

& Corporate

Governance

| Wayland R. Hicks

| | | | l | | l | Rhonda D. Hunter

| | l | | | | l | David L. Jahnke

| | C | | l | | | Judith A. Johansen

| | | | C | | l | William D. Larsson

| | l | | | | C | Michael W. Sutherlin

| | l | | l | | |

l = Member C = Chair

| | | | | | Director | | Audit | | Compensation | | Nominating & Corporate Governance | | | Wayland R. Hicks | | | | • | | • | | | Notice of Annual Meeting of Shareholders and 2018 Proxy Statement | Rhonda D. Hunter | | • | | • | | | | | David L. Jahnke | | C | | • | | | | | Judith A. Johansen | | | | C | | • | | | William D. Larsson | | • | | | | C | | | Glenda J. Minor | | • | | | | • | | | Michael W. Sutherlin | | | 23 | |

| | |

| | Proposal No. 1 – Election of Directors•

|

•= Member C = Chair During fiscal 2018,2021, the Board of Directors held foureight meetings, the Audit Committee held eight meetings, the Compensation Committee held sixfive meetings, and the N&CG Committee held four meetings. Each director attended at least 75% of the aggregate number of meetings of the Board and committees of the Board on which he or she served that were held during the period for which he or she served. We encourage all directors to attend each annual meeting of shareholders. All directors then serving attended the 20182021 annual meeting. Board Leadership The currentBoard periodically assesses its leadership structure in light of the Company’s needs and circumstances. The Board leadership structure separatescurrently combines the role of Chairman and CEO. These roles have been separateCEO and has an independent lead director since May 2005,the Chairman and CEO is a non-independent director. At this time, the Board and the N&CG Committee have determinedbelieves that the current structure continuesCEO, as a Company executive, is in the best position to be appropriate as it enablesfulfill the CEOChairman’s responsibilities, including those related to focus onidentifying emerging issues facing the complexitiesCompany, communicating essential information to the Board about the Company’s performance and challengesstrategies, and proposing agendas for the Board. As detailed in her biography, Ms. Lundgren has over 16 years of experience with the Company, during which time she has held a number of senior executive leadership positions. We believe her in-depth knowledge of the role asCompany and her extensive executive and management experience make her uniquely well-positioned to lead the Board in developing and monitoring the strategic direction of the Company. We believe that our chief executive officer while enablingBoard leadership structure is enhanced by the Chairman to provideindependent leadership at the Board level.provided by our independent lead director. This leadership structure also enables the Board to better fulfill its risk oversight responsibilities, as described under “The Board’s Role in Risk Oversight.”

The Board periodically assesses its leadership structure in light of the Company’s needs and circumstances. The Board also has a lead director, who is an independent director. Under our Corporate Governance Guidelines, the lead director role is periodically rotated among the independent directors.directors, and the role is currently held by Mr. Hicks. The lead director’s responsibilities include: facilitating effective communication between the Board and management; consulting with the Chairman and the CEO;Chairman; and presiding at meetings of the Board when the Chairman is not present, including executive sessions of the independent directors. The lead director generally attends all meetings of the Board’s committees.

| | | | Notice of Annual Meeting of Shareholders and 2021 Proxy Statement | | | 28 |

| | |

| | Proposal No. 1 – Election of Directors |

Board Committees and Responsibilities Audit Committee Chair:David L. Jahnke Additional Members:Rhonda D. Hunter, William D. Larsson, and Michael W. SutherlinGlenda J. Minor Meetings Held in 2018:2021: Eight Independence:Our Board has determined that each member of the Audit Committee meets all additional independence requirements for Audit Committee members under applicable SEC regulations and NASDAQ rules. Audit Committee Financial Literacy and Expertise:Our Board also has determined that each member of the Audit Committee is financially literate under applicable SEC and NASDAQ rules and is an “audit committee financial expert” as defined in regulations adopted by the SEC. The Audit Committee represents and assists the Board in oversight of our accounting and financial reporting processes and the audits of our financial statements; appointing, approving the compensation of, and overseeing the independent auditors; reviewing and approving all audit andnon-audit services performed by the independent auditors; reviewing the scope and discussing the results of the audit with the independent auditors; reviewing management’s assessment of the Company’s internal controls over financial reporting; overseeing the Company’s compliance program; overseeing the Company’s internal audit function; reviewing with management the Company’s major financial risks and legal risks that could have a significant impact on the Company’s financial statements; and reviewing and approving, as appropriate, all transactions of the Company with related persons (see “Certain Transactions”). Compensation Committee Chair:Judith A. Johansen Additional Members:Wayland R. Hicks, David L. Jahnke, Rhonda D. Hunter, and Michael W. Sutherlin Meetings Held in 2018: Six2021: Five Independence:Our Board has determined that each member of the Compensation Committee meets the additional independence standards for Compensation Committee members under the NASDAQ rules and qualifies as anon-employee and outside director under Rule16b-3 under the Securities Exchange Act of 1934 and under section 162(m) of the Internal Revenue Code, respectively. | | | | | 24 | | | Notice of Annual Meeting of Shareholders and 2018 Proxy Statement |

| | |

| | 1934. Proposal No. 1 – Election of Directors

|

Compensation Committee Interlocks and Insider Participation:No members of the Compensation Committee who served during 20182021 were officers or employees of the Company or any of its subsidiaries during the year, were formerly Company officers, or had any relationship otherwise requiring disclosure as a compensation committee interlock. The Compensation Committee has overall responsibility for the administration of the Company’s executive and director compensation plans and equity-based plans; overseeing and evaluating the performance of the CEO and determining the CEO’s compensation; administering and interpreting executive compensation plans, the Company’s stock plans, and all other equity-based plans from time to time adopted by the Company, including our 1993 Amended and Restated Stock Incentive Plan (“SIP”); reviewing and assessing the risks related to the design of the Company’s compensation programs and arrangements determining the compensation of the other executive officers; in consultation with the N&CG Committee, reviewing and recommending to the Board for approval compensation for members of the Board, including compensation paid to the Chairman, Lead Director and committee chairs; and overseeing the preparation of executive compensation disclosures included in the Company’s proxy statement in accordance with the SEC rules and regulations. For a description of the Compensation Committee’s activities regarding executive compensation, refer to the “Compensation Discussion and Analysis.” | | | | Notice of Annual Meeting of Shareholders and 2021 Proxy Statement | | | 29 |

| | |

| | Proposal No. 1 – Election of Directors |

Nominating and Corporate Governance (“N&CG”) Committee Chair:William D. Larsson Additional Members:Wayland R. Hicks, Rhonda D. Hunter, and Judith A. Johansen, Glenda J. Minor, and Michael W. Sutherlin Meetings Held in 2018:2021: Four Independence:Our Board has determined that each member of the N&CG Committee is independent under applicable SEC regulations and NASDAQ rules. The N&CG Committee has responsibility for identifying, selecting, and recommending to the Board individuals proposed to be (i) nominated for election as directors by the shareholders or (ii) elected as directors by the Board to fill vacancies; working with the Chairman of the Board and the Lead Director, seeking to ensure that the Board’s committee structure, committee assignments, and committee chair assignments are appropriate and effective; developing and recommending to the Board for approval, and reviewing from time to time, a set of corporate governance guidelines for the Company, which includes a process for the evaluation of the Board, its committees, and management; reviewing and evaluating risks related to corporate governance practices and leadership succession; developing and maintaining director education opportunities; and monitoring compliance with the corporate governance guidelines adopted by the Board. Assessment of Director Qualifications: The N&CG Committee uses a Board composition matrix to inventory, on at least an annual basis, the expertise, skills, and experience of each director to ensure that the overall Board maintains a balance of knowledge and relevant experience. The Committee carefully reviews all director candidates, including current directors, based on the current and anticipated composition of the Board, our current and anticipated strategy and operating requirements, and the long-term interests of shareholders. In assessing current directors and potential candidates, the N&CG Committee considers the Board composition matrix, as well as the character, background, and professional experience of each current director and potential candidate. In its evaluation of potential candidates, the N&CG Committee applies the criteria set forth in our Corporate Governance GuidelinesN&CG Committee Charter and considers the following factors:factors from our Corporate Governance Guidelines: Qualification as an “independent director”Directors should be of the highest ethical character, exhibiting integrity, honesty, and accountability, with a willingness to express independent thought; Character, integrity, soundSuccessful leadership experience and stature in an individual’s primary field, with a background that demonstrates an understanding of business judgment,affairs and diversitythe complexities of viewpoints and experiencea large, publicly-held company, with particular emphasis on capital-intensive, global businesses; AccomplishmentsDemonstrated ability to think strategically and make decisions with a forward-looking focus, with the ability to assimilate relevant information on a broad range of complex topics; Reputation in the business communityIndependence and absence of conflicts of interest; Knowledge of our industry or other relevant industriesDemonstrated ability to work together and with management collaboratively and constructively; Financial expertise or other specific skillsTime available and willingness to devote the time necessary to effectively fulfill their duties as directors; InquisitiveAn awareness of the social, political, regulatory, and objective perspectiveeconomic environment in which the Company operates; and CommitmentDiversity of experience and availability to conduct Board responsibilitiesbackground. In considering there-nomination of incumbent directors, the N&CG Committee also takes into account the performance of such persons as directors, including the number of meetings attended and the level and quality of participation, as well as the value of continuity and knowledge of the Company gained through Board service. | | | | | | | Notice of Annual Meeting of Shareholders and 2018 Proxy Statement | | | | 25 | |

| | |

| | Proposal No. 1 – Election of Directors

|

Diversity: The N&CG Committee strives to achieve diversity on the Board by considering skills, experience, education, length of service on the Board, and such other factors as it deems appropriate. The N&CG Committee and the Board define diversity broadly to include the background, professional experience, skills, and viewpoints necessary to achieve a balance and mix of perspectives. In evaluating potential director candidates, the N&CG Committee and the Board place particular emphasis on diversity. Confirming our commitment to diversity at the Board level, our director candidate search process ensures that women and minorities are included in the initial pool of candidates when we select new director nominees (aka “the Rooney Rule”). Our Board recognizes the value of diversity and considers how a candidate may contribute to the Board in a way that can enhance perspective and judgment through diversity in gender, age, ethnic background, geographic origin, and professional experience. | | | | Notice of Annual Meeting of Shareholders and 2021 Proxy Statement | | | 30 |

| | |

| | Proposal No. 1 – Election of Directors |

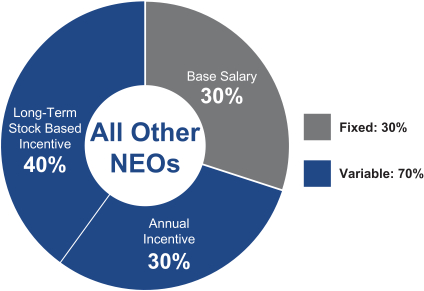

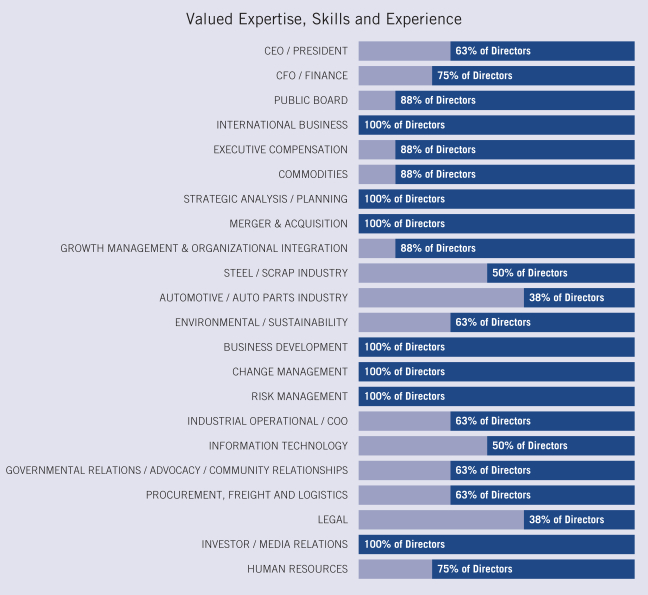

Valued Expertise, Skills and Experience CEO / President 63% of Directors CFO / Finance 75% of Directors Public Board 88% of Directors International Business 100% of Directors Executive Compensation 88% of Directors Commodities 88% of Directors Strategic Analysis / Planning 100% of Directors Merger & Acquisition 100% of Directors Growth Management & Organizational Integration 88% of Directors Steel / Scrap Industry 50% of Directors Automotive / Auto Parts Industry 38% of Directors Environmental / Sustainability 63% of Directors Business Development 100% of Directors Change Management 100% of Directors Risk Management 100% of Directors Industrial Operational / COO 63% of Directors Information Technology 50% of Directors Governmental Relations / Advocacy / Community Relationships 63% of Directors Procurement, Freight and Logistics 63% of Directors Legal 38% of Directors Investor / Media Relations 100% of Directors Human Resources 75% of DirectorsBOARD SKILLS AND EXPERIENCE

| | | | | | |

| | Industry & Operations Experience We seek directors with management, operational, and regulatory experience in the industries in which we compete. These attributes tend to give directors specific insight into, and expertise that will foster active participation in, the development and implementation of our operating and business strategy. | |

| | Global Experience We seek directors with global business experience because selling our ferrous and nonferrous products to customers around the world is a significant aspect of our business. |

| | Investor Experience To promote strong alignment with our investors, we seek directors who have experience overseeing capital investments and investment decisions. We believe that these directors can help focus management and the Board on the most critical value drivers for the Company, including with respect to setting executive compensation targets and objectives. | |

| | Risk Management Experience In light of the Board’s role in overseeing risk management and understanding the most significant risks facing the Company, we seek directors with experience in risk management and oversight. |

| | Finance & Accounting Experience We use a broad set of financial metrics to measure performance, and accurate financial reporting and robust auditing are critical to our success. We have a number of directors who qualify as audit committee financial experts, and we expect all of our directors to have an understanding of finance and financial reporting processes. | |

| | Environmental & Sustainability Experience We seek directors with environmental, sustainability, and regulatory experience as we remain steadfast in our focus on safety, sustainability, and integrity as tenets of our Company’s core strategy to deliver growth and profitability. |

| | | | Notice of Annual Meeting of Shareholders and 2021 Proxy Statement | | | 31 |

| | |

| | Proposal No. 1 – Election of Directors |

Board Self-Assessments The Board conducts an annual self-evaluationsself-evaluation to determine whether it and its committees are functioning effectively and whether its governing documents continue to remain appropriate. Our Board’s self-evaluation is facilitated by a wide range of questions related to topics including operations, composition of the Board, Board diversity, responsibilities, governing documents, and resources. As part of the Board self-evaluation process, each director also conducts an evaluation of the Chairman of the Board and the Lead Director. The process is designed and overseen by the N&CG Committee, and the results of the evaluations are discussed by the full Board. Each committee annually reviews its own performance and assesses the adequacy of its charter and | | | | | 26 | | | Notice of Annual Meeting of Shareholders and 2018 Proxy Statement |

| | |

| | Proposal No. 1 – Election of Directors

|

reports the results and any recommendations to the Board. The N&CG Committee oversees and reports annually to the Board its assessment of each committee’s performance evaluation process. The N&CG Committee coordinates its oversight of the Board self-assessment process with its process for assessment of individual director qualifications. Director Nominations The N&CG Committee identifies potential director candidates through a variety of means, including recommendations from members of the Board, suggestions from Company management, and shareholder recommendations. The N&CG Committee also may, in its discretion, engage director search firms to identify candidates. Shareholders may recommend director candidates for consideration by the N&CG Committee by submitting a written recommendation to Schnitzer Steel Industries, Inc., Attn: Chair of the Nominating & Corporate Governance Committee, c/o Corporate Secretary, 299 SW Clay Street, Suite 350, Portland, Oregon 97201. The recommendation should include the candidate’s name, age, qualifications (including principal occupation and employment history), and written consent to be named as a nominee in our proxy statement and to serve as a director, if elected. All recommendations for nomination received by the Corporate Secretary that satisfy our bylaw requirements relating to such director nominations will be presented to the N&CG Committee for its consideration. The N&CG Committee meets to discuss and consider the qualifications of each potential new director candidate, whether recommended by shareholders or identified by other means, and determines by majority vote whether to recommend such candidate to the Board of Directors. The final decision to either elect a candidate to fill a vacancy between annual meetings or include a candidate on the slate of nominees proposed at an annual meeting is made by the Board of Directors. In considering the current directors, including the director nominees proposed for election at the Annual Meeting, the N&CG Committee and the Board specifically considered the background, experiences, and qualifications described in their biographies appearing under “Proposal 1—Election of Directors” in this proxy statement. Director Tenure We do not have a fixed retirement age for directors. Under our Corporate Governance Guidelines, a director (other than the Chief Executive Officer) is requirednot expected to submitstand for re-election after he or she has served as a written resignationdirector for fifteen years although the Nominating and Corporate Governance Committee may recommend to the Board tothat, based on specific circumstances, the director’s tenure should be effective atextended beyond the endexpiration of the director’s then current term when the director beginsduring which he or she reached his or her 15thfifteenth year of service on the Board. The Board may accept or reject the tendered resignation after considering the recommendation of the N&CG Committee as to the appropriateness of the director’s continued membership on the Board.service. The Board’s Role in Risk Oversight We have a comprehensive enterprise risk management process in which management is responsible for managing the Company’s risks and the Board and its committees provide oversight of these efforts. Our Senior Vice President, Chief Financial Officer & Chief of Corporate Operations reports to our CEO,management-level Enterprise Risk Committee is responsible for the risk management program, and provides periodic reports to the Board.Board at least quarterly and more frequently as circumstances require. Risks are identified, assessed, and managed on an ongoing basis and communicated to management during management meetings or otherwise as appropriate. Existing and potential material risks are reviewed during periodic executive management and/or Board meetings, resulting in Board and/or Board committee discussion and public disclosure, as appropriate. The Board is responsible for overseeing management in the execution of its risk management responsibilities and for assessing the Company’s approach to risk management. The Board administers this risk oversight function either through the full Board or through its standing committees. | | | | | The following are the key risk oversight responsibilities of our Board and its committees: •◾ Full Board: enterprise-wide strategic risks related to our long-term strategies, including capital expenditures, Sustainability, ESG, cybersecurity, and material acquisitions

•◾ Audit Committee: financial risks (including risks associated with accounting, financial reporting, disclosure, and internal controls over

financial reporting), our compliance programs, and legal risks

•◾ Compensation Committee: risks related to the design of the Company’s compensation programs and arrangements

•◾ N&CG Committee: risks related to corporate governance practices and leadership succession

|

| | | | Notice of Annual Meeting of Shareholders and 2021 Proxy Statement | | | 32 |

| | |

| | Proposal No. 1 – Election of Directors |

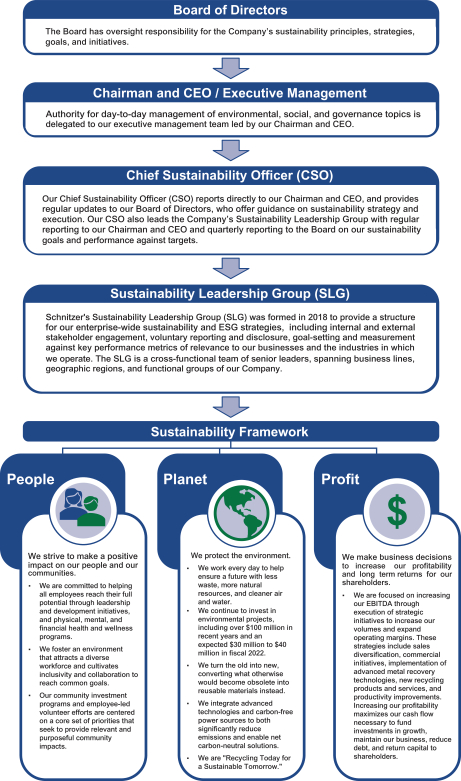

Assessment of Compensation Risk Management andThe Compensation Committee, with the assistance of Pearl Meyer, the Compensation Committee conducted an assessment ofCommittee’s independent compensation consultant, assessed the risks associated with our compensation programs and determined that they do not create risks which are reasonably likely to have a material adverse impact on us. In conducting the evaluation, the Compensation Committee with the assistance of Pearl Meyer, its independent compensation consultant, reviewed our compensation structure and

noted numerous ways in which risk is effectively managed or mitigated, including: Balance of corporate and business unit weighting in incentive plans Mix between short-term and long-term incentives Use of multiple performance measures | | | | | | | Notice of Annual Meeting of Shareholders and 2018 Proxy Statement | | | | 27 | |

| | |

| | Proposal No. 1 – Election of Directors

|

A portfolio of varied long-term incentives Committee discretion in payment of short-term incentives Use of stock ownership guidelines Anti-hedging and anti-pledging policies and prohibition on derivative transactions for Company stock In addition, the Compensation Committee analyzed the overall enterprise risks and how compensation programs could impact individual behavior that could exacerbate these enterprise risks. In light of these analyses, the Compensation Committee believes that the architecture of our compensation programs (executive and broad-based) provide multiple, effective safeguards to protect against undue risk. | | | | Notice of Annual Meeting of Shareholders and 2021 Proxy Statement | | | 33 |

| | |

| | Proposal No. 1 – Election of Directors |

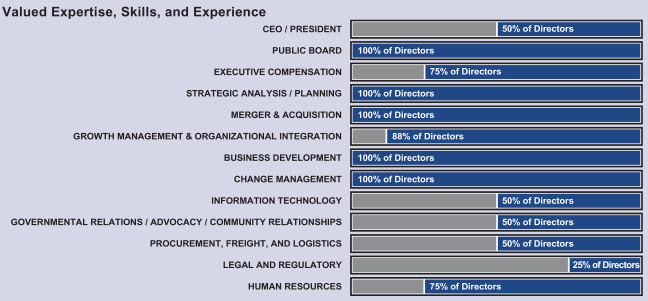

Board Oversight of Sustainability and ESG The Board of Directors view Sustainability and ESG as a core elements of the Company’s strategy and operations. As such, the Board has oversight responsibility and is regularly briefed on progress with respect to Sustainability and ESG goals, including issues relating to human capital and climate.

For more information about our sustainability and ESG efforts, please visit our sustainability microsite at https://sustainability.schnitzersteel.com/. | | | | Notice of Annual Meeting of Shareholders and 2021 Proxy Statement | | | 34 |

| | |

| | Proposal No. 1 – Election of Directors |

Board Oversight of Management Succession Planning Our Board and management consider succession planning and leadership development to be an integral part of the Company’s long-term strategy. At least annually, our full Board reviews senior management succession and development plans with our CEO. Our CEO presents to the full Board her evaluations and recommendations of future candidates for key leadership roles, including for the CEO position, and potential succession timing for those positions, including under emergency circumstances. Following the CEO’s presentation, the Board meets in executive session without our CEO to consider and discuss CEO succession. The Board also reviews and discusses development plans for individuals identified as high-potential candidates for key leadership positions, and the Board members interact with these candidates in formal and informal settings during the year. Prohibition on Hedging, Pledging and Derivative Trading Our stock trading policy, applicable to our directors and employees, prohibits hedging, pledging, and derivative trading in our Company’s stock. Specifically, our stock trading policy prohibits engaging in any short sale of our stock, establishing or using a margin account with a broker-dealer for the purpose of buying or selling our stock or using it as collateral therefor, or buying or selling puts, calls, prepaid variable forward contracts, equity swaps, collars, exchange funds, or other instruments or derivatives designed to hedge the value of our stock. Our Commitment to Sustainable Business Practices

As one of our core values, sustainable business practices set the foundation for our longevity and continued success. We view sustainability as integrated into our business, a key component of our long-term strategy, and essential to our future growth and success.

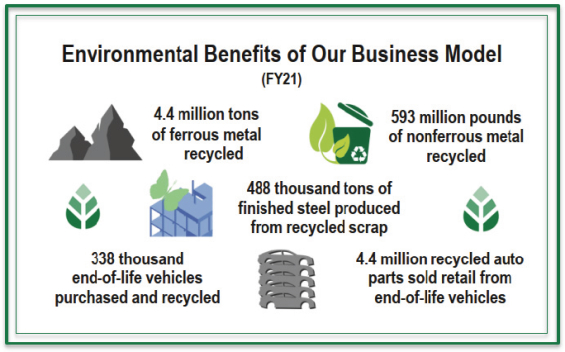

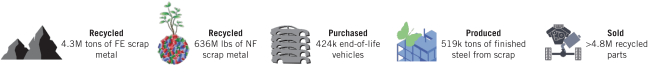

We are one of North America’s largest recyclers of scrap metal, a leading provider of used and recycled auto parts, and a manufacturer of finished steel products from recycled metal. The very essence of our business model is predicated on recycling - a cornerstone for sustainability. Our automotive and metals recycling facilities process scrap metals for reuse by steel mills globally, and our steel mill produces finished products from recycled metals, conserving natural resources and significantly reducing greenhouse gas emissions.

To increase the transparency of our sustainable business practices with our various stakeholders, we publish an annual Sustainability Report which focuses on:

In November 2018, we released our fifth annual Sustainability Report which covered fiscal 2017 and 2018 and continued to show year-over-year reductions in our carbon emissions, energy consumption, water usage, and process waste generation on a normalized(per-unit) basis. We are committed to operating our business in a safe, efficient, and environmentally responsible manner.

Key Performance Indicators (KPIs) we report on are aligned with internationally recognized standards and have been assured by independent analysis for materiality and accuracy. In order for us to further develop our sustainability strategy and identify levers and approaches to improve our sustainability performance, we appointed a Vice President, Chief Sustainability Officer as a direct report to the CEO in fiscal 2017.

In 2018, for the fourth year in a row, Schnitzer was named a World’s Most Ethical Company by the Ethisphere Institute, a global leader in defining and advancing the standards of ethical business practices. We also, again, earned the Ethics Inside© Certification and Anti-Bribery Program Verification, endorsements of our Company’s commitment to ethical business practices.

Additional information on our commitment to sustainable business practices is included in the Proxy Summary at page 3.

Please also visit:

http://www.schnitzersteel.com/sustainability_report.aspx to view our latest the Sustainability Report, which presents our KPIs and profiles the best practices we employ to ensure the sustainability of our business and the communities in which we operate.

| | | | | 28 | | | Notice of Annual Meeting of Shareholders and 2018 Proxy Statement |

| | |

| | Proposal No. 1 – Election of Directors

|

Communication with Directors Shareholders and other interested parties may communicate with any of the directors, including our lead independent director, by using the following address: Board of Directors Schnitzer Steel Industries, Inc. 299 SW Clay Street, Suite 350 Portland, OR 97201 The office of the Corporate Secretary reviews correspondence received and will filter advertisements, solicitations, spam, and other such items not related to a director’s duties and responsibilities. All other relevant correspondence addressed to a director will be forwarded to that director, or if none is specified, to the Chairman of the Board. | | | | Notice of Annual Meeting of Shareholders and 2021 Proxy Statement | | | 35 |

| | |

| | Proposal No. 1 – Election of Directors |

Non-Employee Director Compensation Our non-employee directors receive cash compensation as well as equity compensation in the form of DSUsDeferred Stock Units (DSUs) for their Board service. Compensation forour non-employee directors is set by the Board at the recommendation of the Compensation Committee. Guiding Principles Fairly compensate directors for their responsibilities and time commitments. Attract and retain highly qualified directors by offering a compensation program consistent with those at companies of similar size, scope, and complexity. Align the interests of directors with our shareholders by providing a significant portion of compensation in equity and setting an expectation pursuant to theour Corporate Governance Guidelines that directors acquire and continue to own our common stock with a value equal to five times the director’s annual cash retainer. Provide compensation that is simple and transparent Directors are expected to shareholders.achieve this stock ownership level within a period of five years.

Review Process The Compensation Committee, which consists solely of independent directors, periodically assesses the form and amountof non-employee director compensation and recommends changes, if appropriate, to the Board based upon competitive market practices. The Compensation Committee’s independent compensation consultant also supports the Compensation Committee in determining director compensation and designing the related benefit programs. As part of its periodic review, the Compensation Committee conducts extensive benchmarking by reviewing director compensation data for the executive compensation peer group described in “Competitive Market Overview” on page 38.45. | | | | Notice of Annual Meeting of Shareholders and 2021 Proxy Statement | | | 36 |

| | |

| | Proposal No. 1 – Election of Directors |

Annual Compensation The following table sets forth certain information concerning compensation paid to directors other than Ms. Lundgren, our CEO, during the fiscal year ended August 31, 2018 (unless otherwise noted in the footnotes to the table).2021. | | | | | | | | | | | | | | | | | | | | | Name | | Fees Earned or Paid in Cash ($)(1) | | | Stock Awards ($)(2) | | | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | | | All Other Compensation ($) | | | Total ($) | | David J. Anderson(4) | | | 29,361 | | | | — | | | | — | | | | — | | | | 29,361 | | John D. Carter | | | 300,000 | | | | — | | | | — | (3) | | | — | | | | 300,000 | | Wayland R. Hicks | | | 105,000 | | | | 119,993 | | | | — | | | | — | | | | 224,993 | | Rhonda D. Hunter | | | 65,421 | | | | 119,993 | | | | — | | | | — | | | | 185,414 | | David L. Jahnke | | | 92,547 | | | | 119,993 | | | | — | | | | — | | | | 212,540 | | Judith A. Johansen | | | 92,547 | | | | 119,993 | | | | — | | | | — | | | | 212,540 | | William D. Larsson | | | 85,805 | | | | 119,993 | | | | — | | | | — | | | | 205,798 | | Michael W. Sutherlin | | | 75,805 | | | | 119,993 | | | | — | | | | — | | | | 195,798 | |

| | | | | | | Notice of Annual Meeting of Shareholders and 2018 Proxy Statement | | | | 29 | |

| | |

| | Proposal No. 1 – Election of Directors

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | Name | | Fees Earned or Paid in Cash ($)(1) | | Stock Awards ($)(2) | | Change in Pension Value and Nonqualified Deferred Compensation

Earnings ($)(3) | | Total ($) | John D. Carter(4) | | | | 122,500 | | | | | — | | | | | (26,491) | | | | | 96,009 | | Wayland R. Hicks | | | | 105,000 | | | | | 119,980 | | | | | 3,221 | | | | | 228,201 | | Rhonda D. Hunter | | | | 90,000 | | | | | 119,980 | | | | | — | | | | | 209,980 | | David L. Jahnke | | | | 115,000 | | | | | 119,980 | | | | | 15,631 | | | | | 250,611 | | Judith A. Johansen | | | | 108,000 | | | | | 119,980 | | | | | — | | | | | 227,980 | | William D. Larsson | | | | 100,000 | | | | | 119,980 | | | | | 8,515 | | | | | 228,495 | | Glenda J. Minor | | | | 72,940 | | | | | 145,757 | | | | �� | — | | | | | 218,697 | | Michael W. Sutherlin | | | | 90,000 | | | | | 119,980 | | | | | — | | | | | 209,980 | |

| (1) | Fees earned includes amounts deferred at the election of a director under the Deferred Compensation Plan forNon-Employee Directors, which is described below. |

| (2) | Represents the aggregate grant date fair value of awards computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Classification (“ASC”) Topic 718. These amounts reflect the grant date fair value and may not correspond to the actual value that will be realized by the directors. Stock awards consist of DSUs valued using the closing market price of the Company’s Class A common stock on the NASDAQ Global Select Market on the grant date. On January 30, 2018,26, 2021, the date of the Company’s 20182021 annual meeting, each director then in office other than Mr. Carter and Ms. Lundgren was granted DSUs for 3,4584,006 shares. The grant date fair value of this DSU grant to each director was $119,993$119,980 (or $34.70$29.95 per share) which was equal to the closing market price of the Company’s Class A common stock on the grant date. These DSUs vest on January 28, 201924, 2022 (the day before the 20192022 Annual Meeting), subject to continued Board service. The amount for Ms. Minor also includes a grant of 1,158 DSUs on November 9, 2020 in connection with her appointment to the Board. The grant date fair value of this DSU grant to Ms. Minor was $25,777 (or $22.26 per share) which was equal to the closing market price of the Company’s Class A common stock on the grant date. The DSUs become fully vested on the earlier death or disability of a director or a change in control of the Company (as defined in the DSU award agreement). After the DSUs have become vested, directors will be credited with additional whole or fractional shares to reflect dividends that would have been paid on the stock underlying the DSUs subsequent to the grant date. The Company will issue Class A common stock to a director for the vested DSUs in a lump sum in January of the year following the year the director ceases to be a director of the Company, subject to the right of the director to elect an installment payment program under the Company’s Deferred Compensation Plan forNon-Employee Directors. |

| At August 31, 2018, allnon-employee directors, excluding Mr. Carter, held 3,458At August 31, 2021, all non-employee directors, excluding Mr. Carter, held 4,006 shares of unvested DSUs.

|

| (3) | RepresentsWith respect to Mr. Carter, the amount represents a decrease of $21,067$26,491 in the actuarial present value of Mr. Carter’s accumulated benefits under the Company’s Pension Retirement Plan and the Company’s Supplemental Executive Retirement Bonus Plan. At August 31, 2018,2021, the actuarial present value of Mr. Carter’s accumulated benefits under these plans was $404,130.$429,479. During fiscal 2018,2021, Mr. Carter received distributions of $26,141 under the Supplemental Executive Retirement Bonus Plan and distributions of $9,071 under the Pension Retirement Plan. With respect to Messrs. Hicks, Jahnke and Larsson, the directors who have elected to defer a portion of their director cash fees in accordance with the Company’s non-qualified deferred compensation plan for non-employee directors, the amounts represent the amount of interest earned on the amounts deferred that exceeds the amount of interest calculated using 120% of the applicable federal long-term rate.

|

| (4) | Mr. Anderson ceased to be a director onCarter retired from the Board effective January 30, 2018,26, 2021, the date of the Company’s 20182021 annual meeting. |

Fiscal 2021 director fees did not increase as compared to fiscal 2020. The annual fee fornon-employee directors is $80,000$90,000 ($105,000 for the Lead Director). We do not pay fees for attendance at Board and committee meetings. The annual cash retainer for the Chairs of the Audit, Compensation, and CompensationN&CG Committees is $25,000, $18,000 and for the Chair of the N&CG Committee is $10,000.$10,000, respectively. The Lead Director and Committee Chairs receive additional compensation due to the increased workload and additional responsibilities associated with these positions. In 2004, directors began participating in the Company’s SIP, and in 2004 and 2005non-employee directors received stock option grants. Since August 2006,non-employee directors have been awarded DSUs instead of stock options. One DSU gives the director the right to receive one share of Class A common stock at a future date (as described in footnote 2 above). At each annual meeting of shareholders, eachnon-employee director receives DSUs for a number of shares equal to $120,000 divided by the closing market price of the Class A common stock on the grant date.